Your Solar Generator Credits and Rebates Guide.

A solar generator or a complete solar-plus-battery system is a wise investment in energy independence and emissions reduction. For U.S. homeowners, initial costs can be significantly reduced by federal and state incentives. These tax credits and rebates make clean energy more affordable, though regulations can be complex and deadlines may apply.

To help you navigate available incentives, this guide first outlines key federal credits for solar generators and batteries, then explains how they work, and finally reviews relevant state and local rebates. Understanding these incentives maximizes your savings and solar investment.

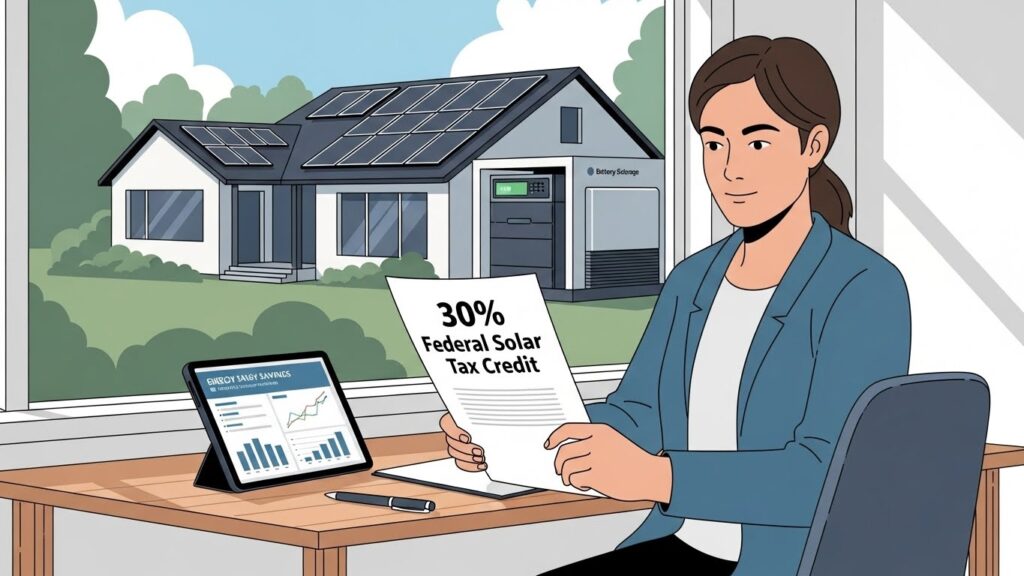

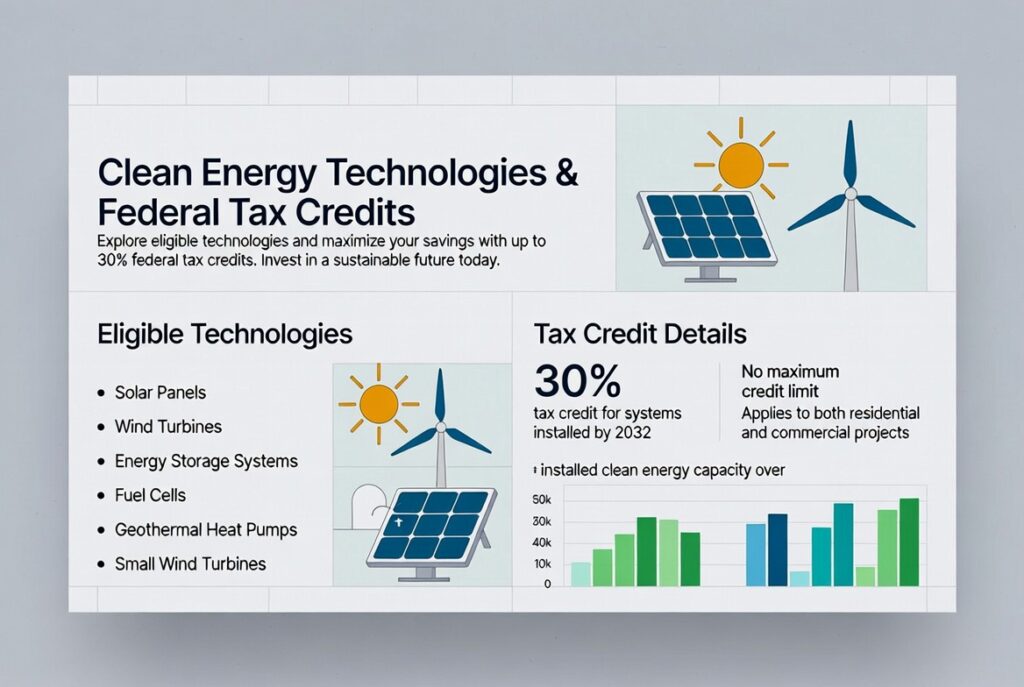

The Federal Residential Clean Energy Tax Credit.

The federal Residential Clean Energy Credit is the most valuable financial incentive available to U.S. homeowners. The program spurs the use of clean energy by offering a substantial tax credit.

What it is

The Residential Clean Energy Credit allows homeowners to receive a 30% credit on the total cost of a qualifying clean energy property installed in their primary U.S. residence. This non-refundable credit directly reduces your tax liability, giving you substantial savings on your solar investment.

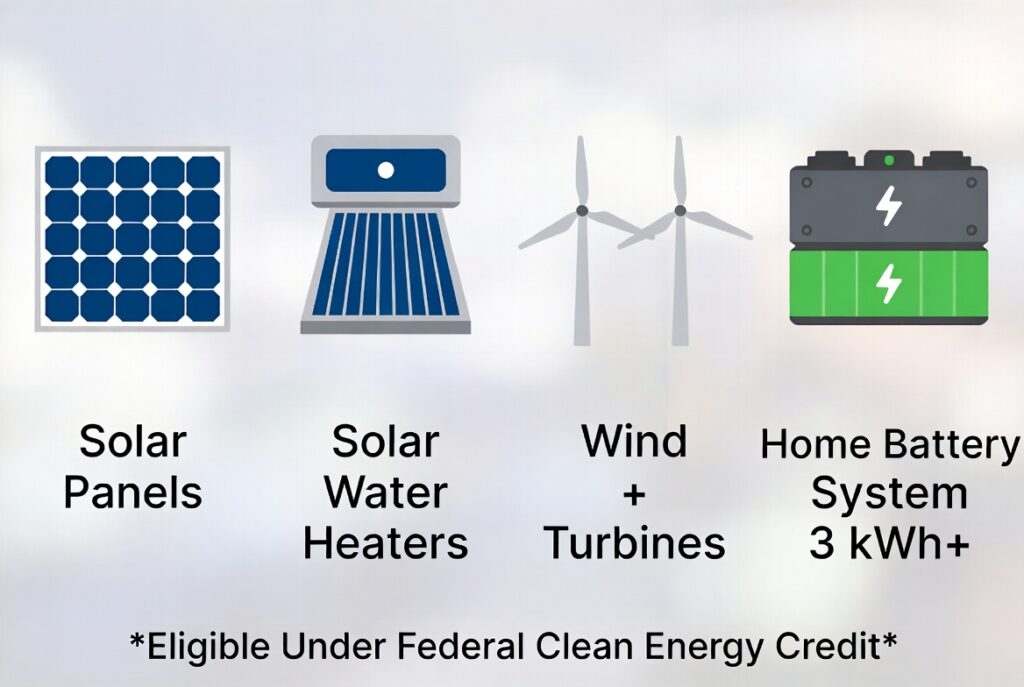

What is considered to be qualified clean energy property?

The IRS specifies several types of property eligible for this credit: solar electric panels, solar water heaters, and wind turbines. More notably, as of 2023, the credit also applies to battery storage systems with a capacity of at least 3 kWh. This is a key update for anyone considering a solar generator or home battery backup system.

Carefully check if your solar generator—often a portable power station—qualifies. Eligibility usually depends on whether it is permanently installed and linked to your home.

Deadlines & phase-out

The tax credit covers 30 percent of qualifying property in service between 2022 and 2032, after which it phases down to 26% in 2033, 22% in 2034, and then ends. The system must be installed and operational within the tax year in which you claim the credit.

How to claim it

Take advantage of filling out Form 5695, used by the IRS, with your tax return. It can cut your tax bill to none, but it is not refundable; unused credit carries forward to future years.

With this foundation in place, the following sections will clarify how these federal and state incentives specifically impact solar generators and battery systems.

The inclusion of battery storage in the federal tax credit is a game-changer, though the details are essential, particularly for portable solar generators.

Are solar generators that can be carried around eligible?

This area remains unclear. To be eligible, a solar generator must be classified as battery storage technology by the IRS. Regulations generally apply to permanently installed components in your home’s electrical system. Portable units often do not satisfy these criteria. Always consult the manufacturer’s instructions and a tax specialist to ensure compliance.

To further enhance your eligibility, consider how combining solar panels with battery storage may affect your incentives.

Eligibility is more likely when installing a conventional solar panel unit with a battery pack. Unit. This combination qualifies fully as a clean energy property, with the credit applying to the panels, battery, installation labor, and necessary wiring or mounting equipment.

What to check

Check the following before purchasing to be able to claim the credit:

- Ownership: Homeowners typically cannot claim credits for leased systems or Power Purchase Agreements (PPAs).

- Installation Date: The system should be put into service within the allowed time.

- Technical Specs: Some state and local incentives require specific equipment standards. Review these criteria in addition to federal regulations.

- Home Type: The house should be your home in the U.S.

In addition to federal incentives, state and local rebates can further reduce costs.

Many states, cities, and utilities also provide incentives that further boost your total savings when combined with the federal credit.

To clarify the state-level landscape, the following section breaks down the main types of state incentives you might encounter.

These include state tax credits, cash rebates, property tax exemptions for system value, or performance-based payments for generated energy.

How to find them

A reliable source for local incentives is The Database of State Incentives for Renewables and Efficiency, a U.S. program run by the Department of Energy. You may also visit your state energy agency website and local utility provider to discover available programs in your area.

Things to watch

When reviewing local incentives, focus on these key details:

- Eligibility Criteria: Some programs apply solely to permanent rooftop solar panels, not to portable systems.

- Application Deadlines: Many local programs are limited in funding and have stringent deadlines.

- Equipment Rules: Equipment must be new and purchased from a vendor on the approved list.

Example Calculation

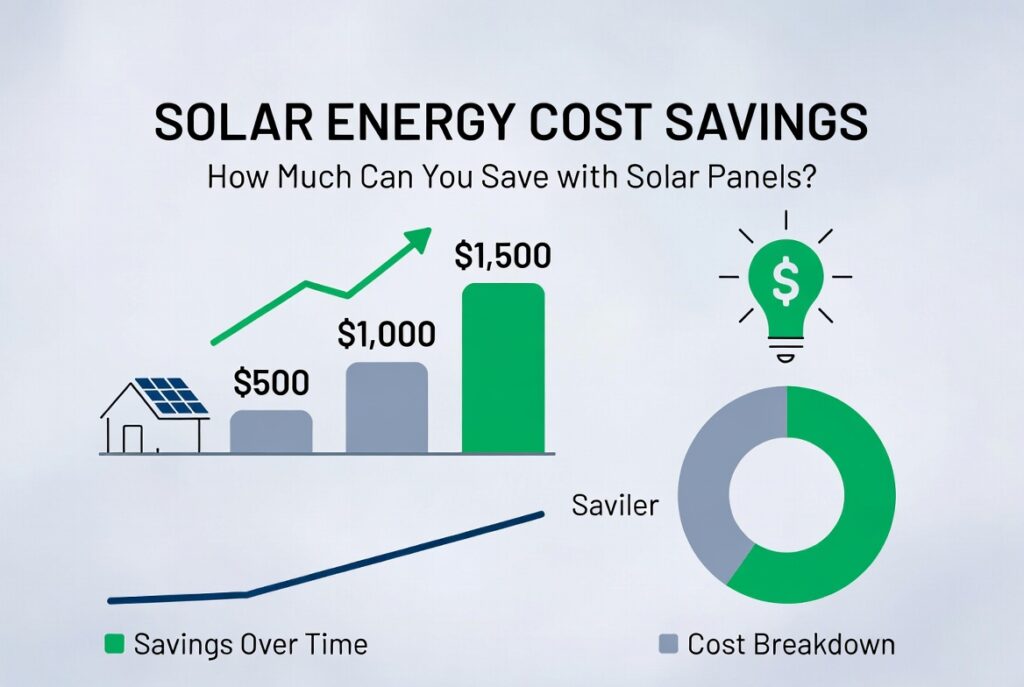

Let’s illustrate how these incentives can be combined.

Suppose you buy and install a qualifying solar panel and battery system for $10,000.

Federal Tax Credit: You can claim a 30 percent tax credit on the system cost.

$10,000 x 30% = $3,000

This reduces your net cost to $7,000.

State Rebate: Next, we will consider a $500 state rebate.

Your new net cost is $6,500.

Assuming that you owe the government just $2000 in federal taxes in the current year, you would claim $2000 of the credit to pay no taxes whatsoever. The remaining credit of $1,000 could be carried forward to the following tax year.s & Tips

Successfully navigating these incentives requires careful planning. Consider these key tips:

Ensure your system is installed correctly and operational within the eligible timeframe.

Leased systems: For leased systems or PPAs, the owner company, not the user, claims the tax credit.

Retain all records: Store all invoices, receipts, and installation records. This record is essential in case the IRS has any questions.

Always consult a tax advisor, as regulations evolve and personal circumstances can affect eligibility.

Check the eligibility of portable generator twice: Do not assume that the entire amount of a portable generator is eligible unless you have verified that it is home-integrated battery storage as per the IRS.

Maximizing Your Solar Savings

Federal and local incentives are an excellent way for U.S. homeowners to afford solar generators or battery systems. These programs support sound investment, energy security, and a cleaner environment.

Regulations are strict, and deadlines may be approaching. Take action now—begin researching local incentives and set up a consultation with a tax professional to secure your savings before some programs expire after 2025.

For personalized support when choosing your equipment, visit myelectricgenerators.com to access model reviews, detailed qualification checklists, and ensure you take the proper steps to maximize incentives.